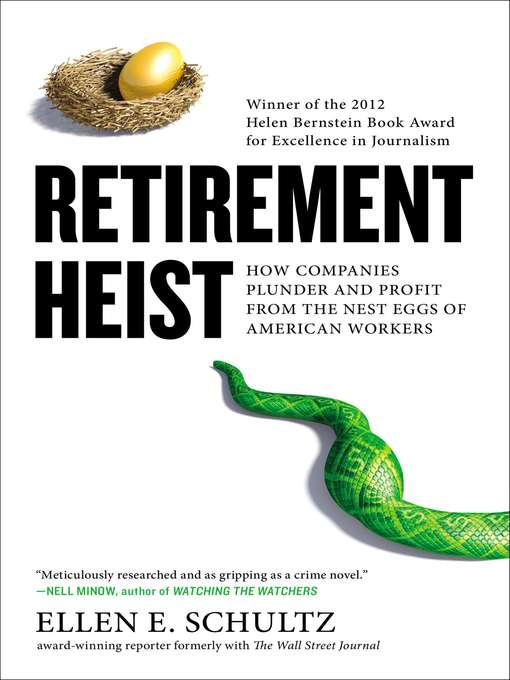

It's no secret that hundreds of companies have been slashing pensions and health coverage earned by millions of retirees. Employers blame an aging workforce, stock market losses, and spiraling costs- what they call "a perfect storm" of external forces that has forced them to take drastic measures.

But this so-called retirement crisis is no accident. Ellen E. Schultz, award-winning investigative reporter for the Wall Street Journal, reveals how large companies and the retirement industry-benefits consultants, insurance companies, and banks-have all played a huge and hidden role in the death spiral of American pensions and benefits.

A little over a decade ago, most companies had more than enough set aside to pay the benefits earned by two generations of workers, no matter how long they lived. But by exploiting loopholes, ambiguous regulations, and new accounting rules, companies essentially turned their pension plans into piggy banks, tax shelters, and profit centers.

Drawing on original analysis of company data, government filings, internal corporate documents, and confidential memos, Schultz uncovers decades of widespread deception during which employers have exaggerated their retiree burdens while lobbying for government handouts, secretly cutting pensions, tricking employees, and misleading shareholders. She reveals how companies:

Though the focus is on large companies-which drive the legislative agenda-the same games are being played at smaller companies, non-profits, public pensions plans and retirement systems overseas. Nor is this a partisan issue: employees of all political persuasions and income levels-from managers to miners, pro- football players to pilots-have been slammed.

Retirement Heist is a scathing and urgent expose of one of the most critical and least understood crises of our time.